Printable Small Business Tax Deductions Worksheet

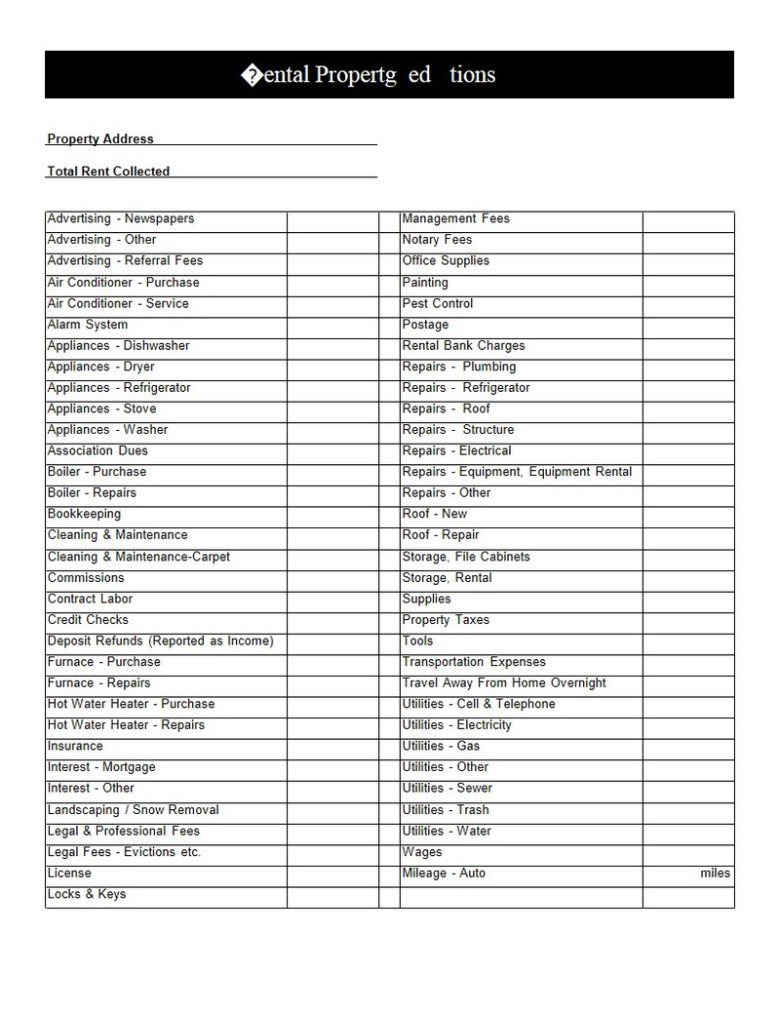

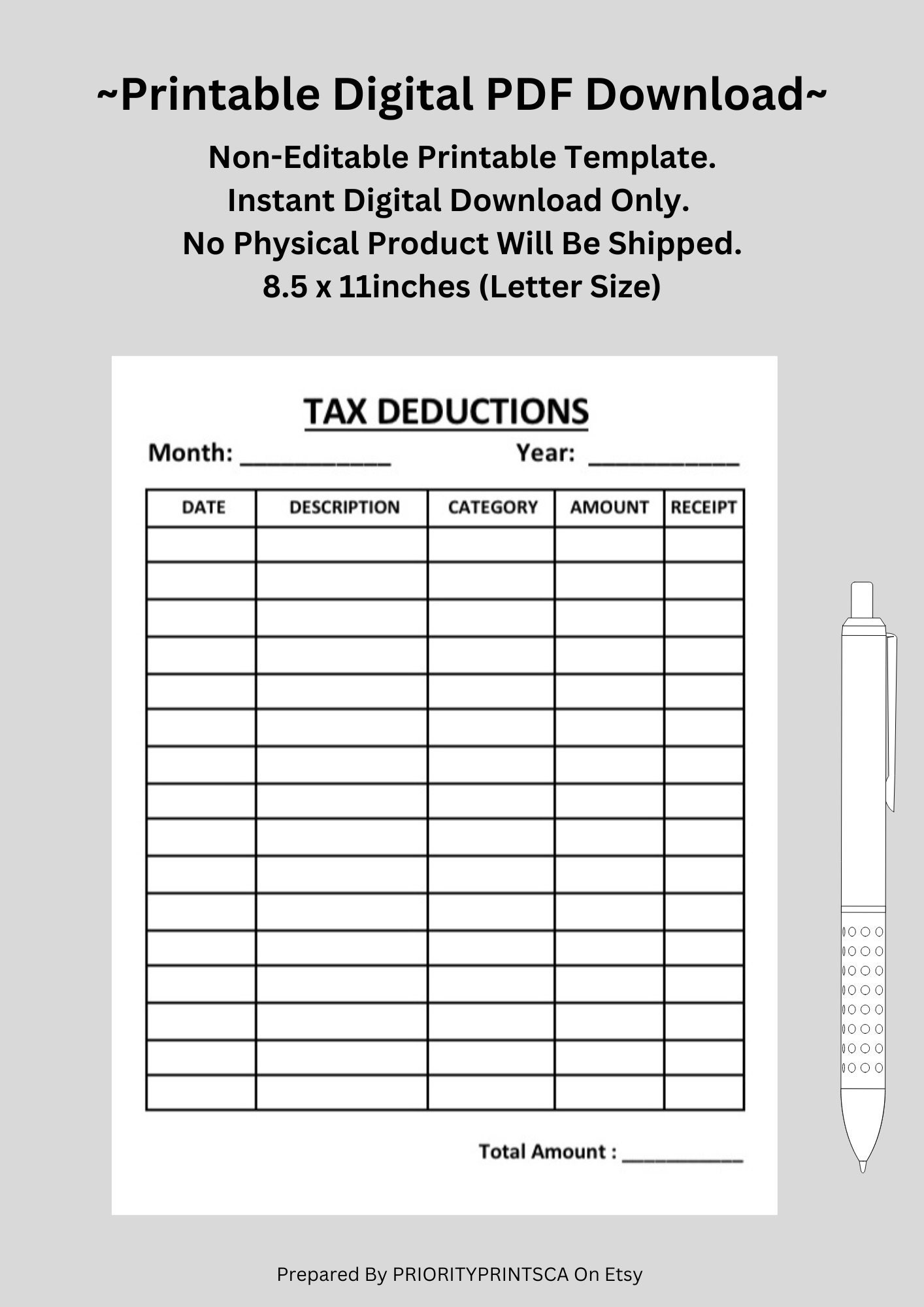

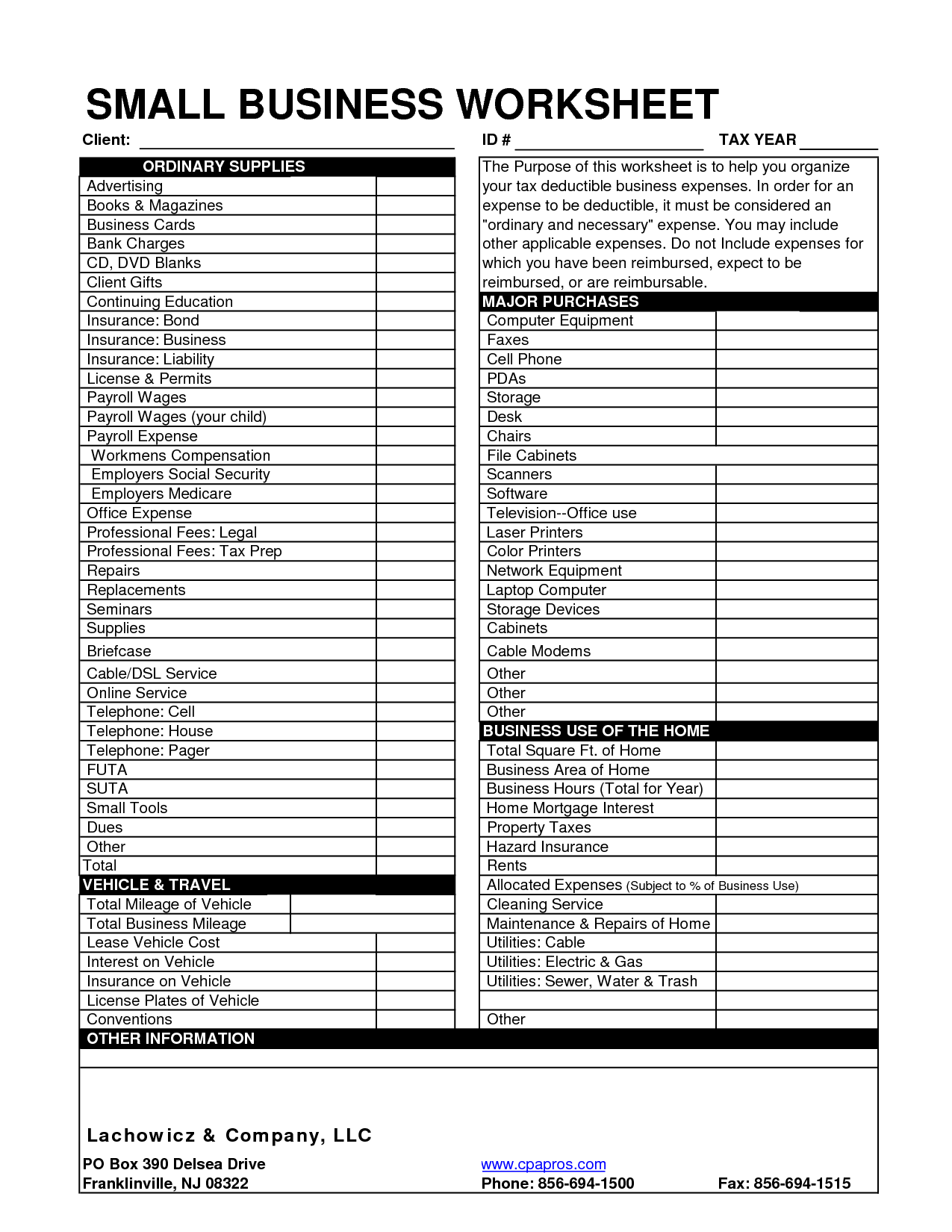

Printable Small Business Tax Deductions Worksheet - Up to 24% cash back what does a tax worksheet do? Otherwise, reporting total figures on this form. When we’re done, you’ll know. At casey moss tax, we have a free spreadsheet template that you can use to organize all of your expenses by transaction and even generate a profit and loss statement for. But knowing what small business tax deductions to claim can make the process easier and save you money at the same time. Filing taxes for the first time can be a challenge. Stay afloat even if your business takes a hit. Following these guidelines—and the advice of a financial. If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Business rent (rent for office or practice space) equipment repairs (repairs on computers, equipment, etc.) supplies (any small items needed for bus.) taxes & licenses (business. Up to 24% cash back what does a tax worksheet do? Let’s get into the details. Otherwise, reporting total figures on this form. If you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and. Itemized deductions worksheet you will need: As a small business owner, you have many options for lowering your taxable income. Tax information documents (receipts, statements, invoices, vouchers) for your own records. To ensure you capture all possible allowable deductions, use our comprehensive checklist:. Use a separate worksheet for each business owned/operated. Use a separate worksheet for each business owned/operated. Let’s get into the details. Following these guidelines—and the advice of a financial. As a small business owner, you have many options for lowering your taxable income. The source information that is required for each tax return is. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Download our small business tax deduction worksheet tax deduction checklist highlights. Download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Use a separate worksheet for each business owned/operated. Itemized deductions worksheet you will need: As a small business owner, you have many options for lowering your taxable income. Tax information documents (receipts, statements, invoices, vouchers) for your own records. When we’re done, you’ll know. If you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and. That’s because the government allows. The source information that is required for each tax return is. Business rent (rent for office or practice space) equipment repairs (repairs on computers, equipment, etc.) supplies (any small items needed for bus.) taxes & licenses (business. To ensure you capture all possible allowable deductions, use our comprehensive checklist:. That’s because the government allows business owners to deduct most of. Here are twenty major tax deductions for small business owners that may surprise you: Our ultimate small business tax. The source information that is required for each tax return is. Business rent (rent for office or practice space) equipment repairs (repairs on computers, equipment, etc.) supplies (any small items needed for bus.) taxes & licenses (business. Otherwise, reporting total figures. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. To ensure you capture all possible allowable deductions, use our comprehensive checklist:. If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. When we’re done, you’ll know. Otherwise, reporting total figures. If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. The source information that is required for each tax return is. Business rent (rent for office or practice space) equipment repairs (repairs on computers, equipment, etc.) supplies (any small items needed for bus.) taxes & licenses (business.. Up to 24% cash back what does a tax worksheet do? Download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. To ensure you capture all possible allowable deductions, use our comprehensive checklist:. If your business has no income, the burden on you will be to. The source information that is required for each tax return is. At casey moss tax, we have a free spreadsheet template that you can use to organize all of your expenses by transaction and even generate a profit and loss statement for. Tax information documents (receipts, statements, invoices, vouchers) for your own records. To ensure you capture all possible allowable. Itemized deductions worksheet you will need: When you're a small business owner and income tax season approaches it's nice to know that you can cover all the bases for small business tax deductions. Use our free printable small business tax deductions worksheet to make sure you haven’t forgotten anything; Download our small business tax deduction worksheet tax deduction checklist highlights.. Up to 24% cash back what does a tax worksheet do? Our ultimate small business tax. But knowing what small business tax deductions to claim can make the process easier and save you money at the same time. To ensure you capture all possible allowable deductions, use our comprehensive checklist:. As a small business owner, you have many options for lowering your taxable income. Use a separate worksheet for each business owned/operated. Itemized deductions worksheet you will need: The source information that is required for each tax return is. At casey moss tax, we have a free spreadsheet template that you can use to organize all of your expenses by transaction and even generate a profit and loss statement for. Stay afloat even if your business takes a hit. For your business to be deductible.) did you pay $600 or more in total during the. When we’re done, you’ll know. That’s because the government allows business owners to deduct most of the expenses that they. Otherwise, reporting total figures on this form. Filing taxes for the first time can be a challenge. Talk to your insurance agent to determine the best coverage for your specific needs and to ensure.Small Business Tax Deductions Worksheet

Tax Deductions Sheet. Business Tax Deductions. Personal Tax Deductions

Small Business Itemized Deductions Worksheet

Printable Self Employed Tax Deductions Worksheet Small Busin

Self Employment Printable Small Business Tax Deductions Work

Itemized Deduction Small Business Tax Deductions Worksheet Printable

10++ Small Business Tax Deductions Worksheet Worksheets Decoomo

Small Business Expenses Printable Self Employed Tax Deductio

Tax Deduction Worksheet 2023

Small Business Tax Deductions Worksheet Self Employment Prin

Download Our Free 2022 Small Business Tax Deductions Worksheet, And We’ll Walk You Through How To Use It Right Now In This Blog Post.

Use Our Free Printable Small Business Tax Deductions Worksheet To Make Sure You Haven’t Forgotten Anything;

Download Our Small Business Tax Deduction Worksheet Tax Deduction Checklist Highlights.

When You're A Small Business Owner And Income Tax Season Approaches It's Nice To Know That You Can Cover All The Bases For Small Business Tax Deductions.

Related Post: