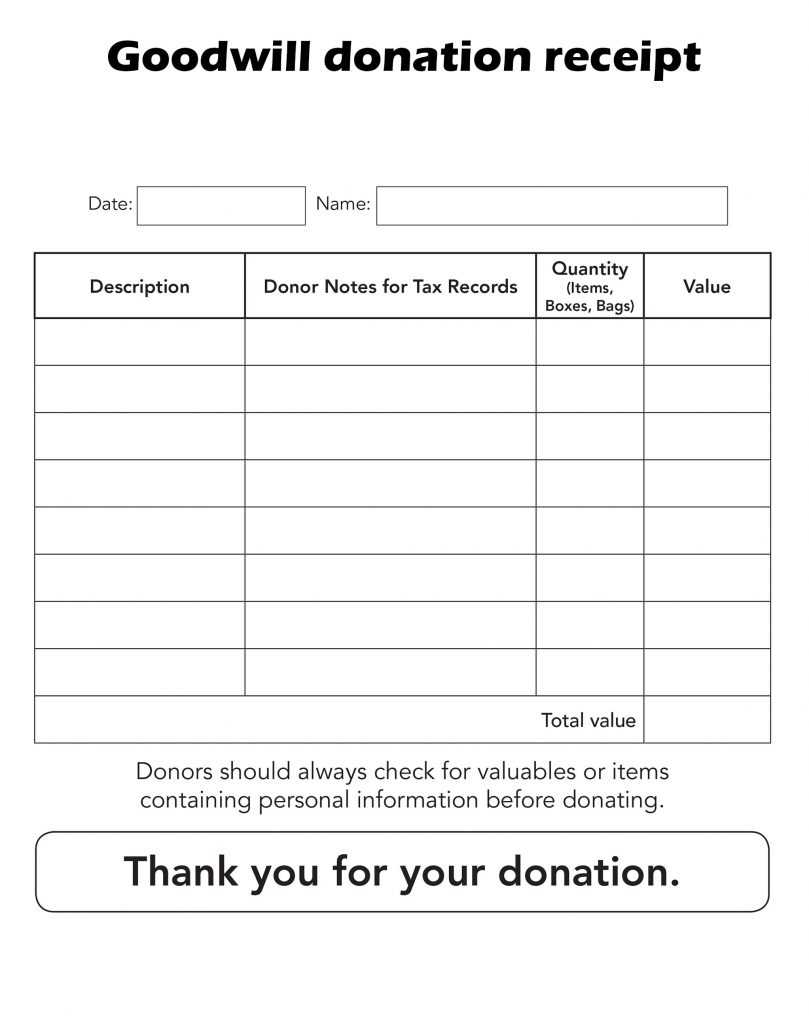

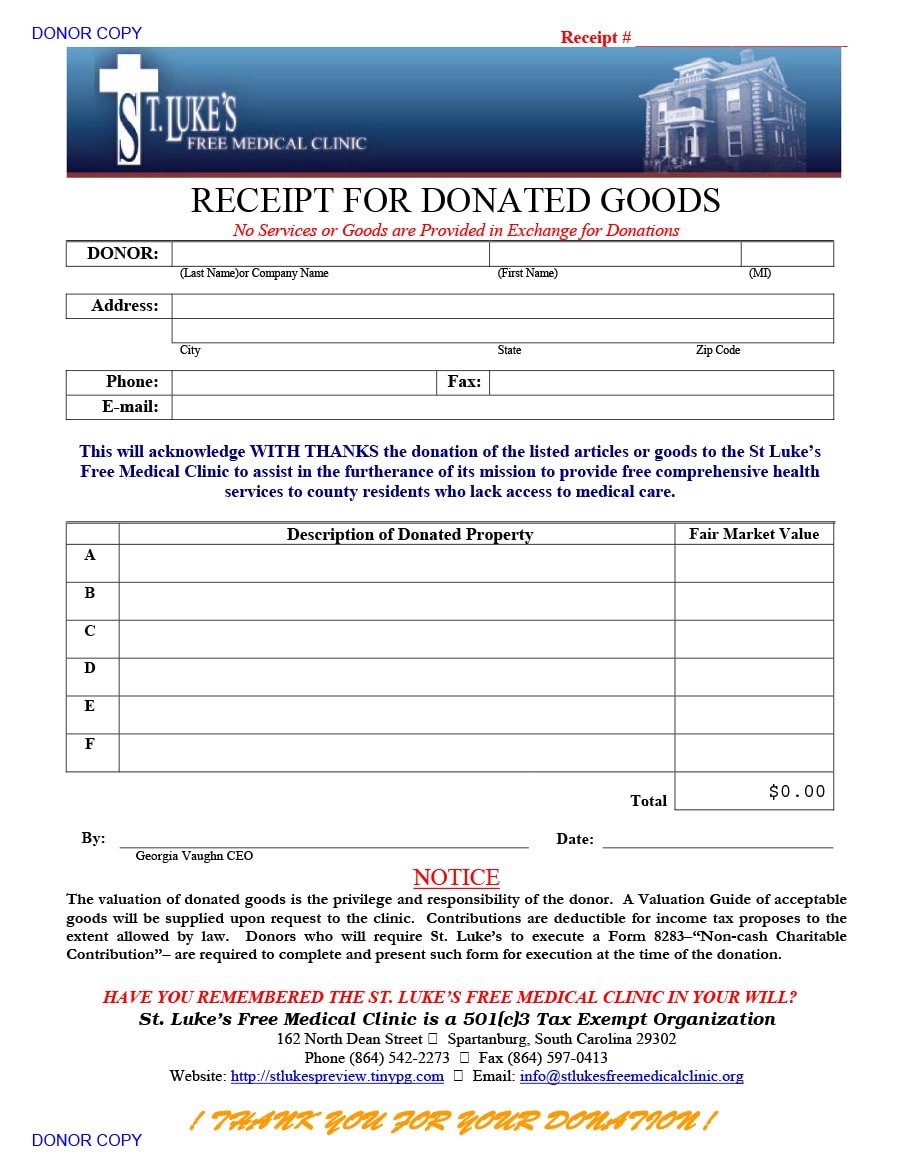

Printable Goodwill Donation Receipt

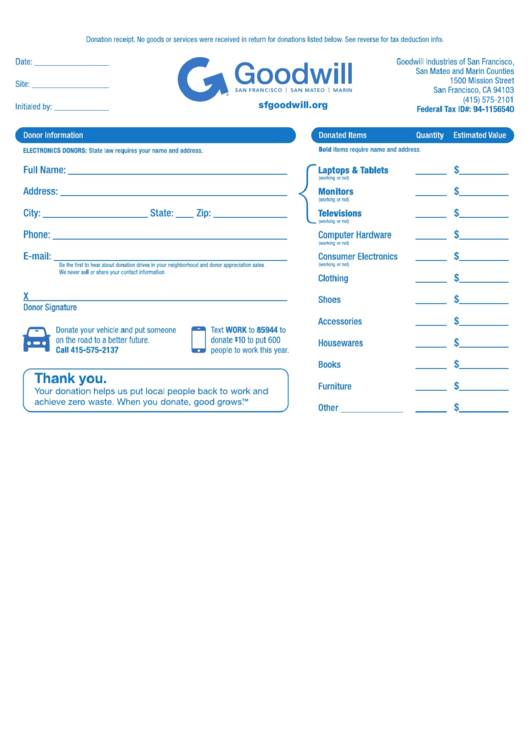

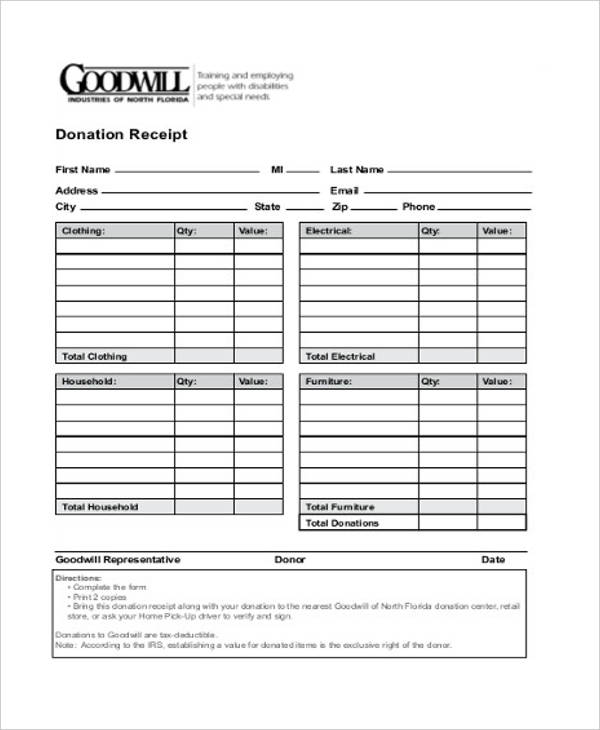

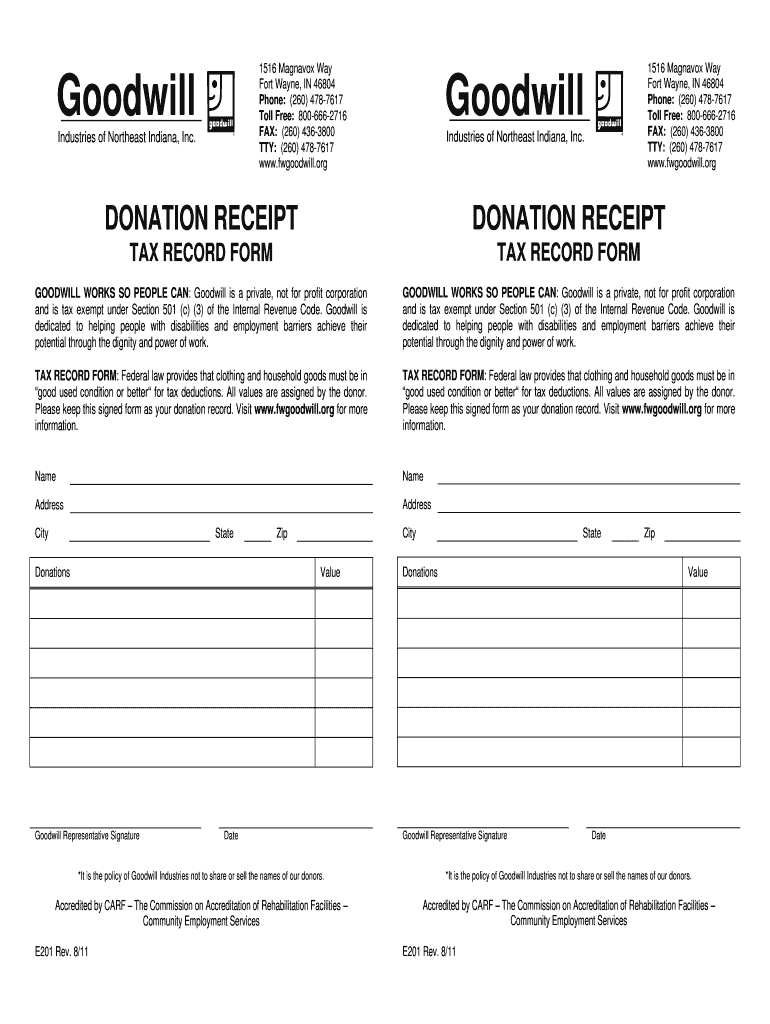

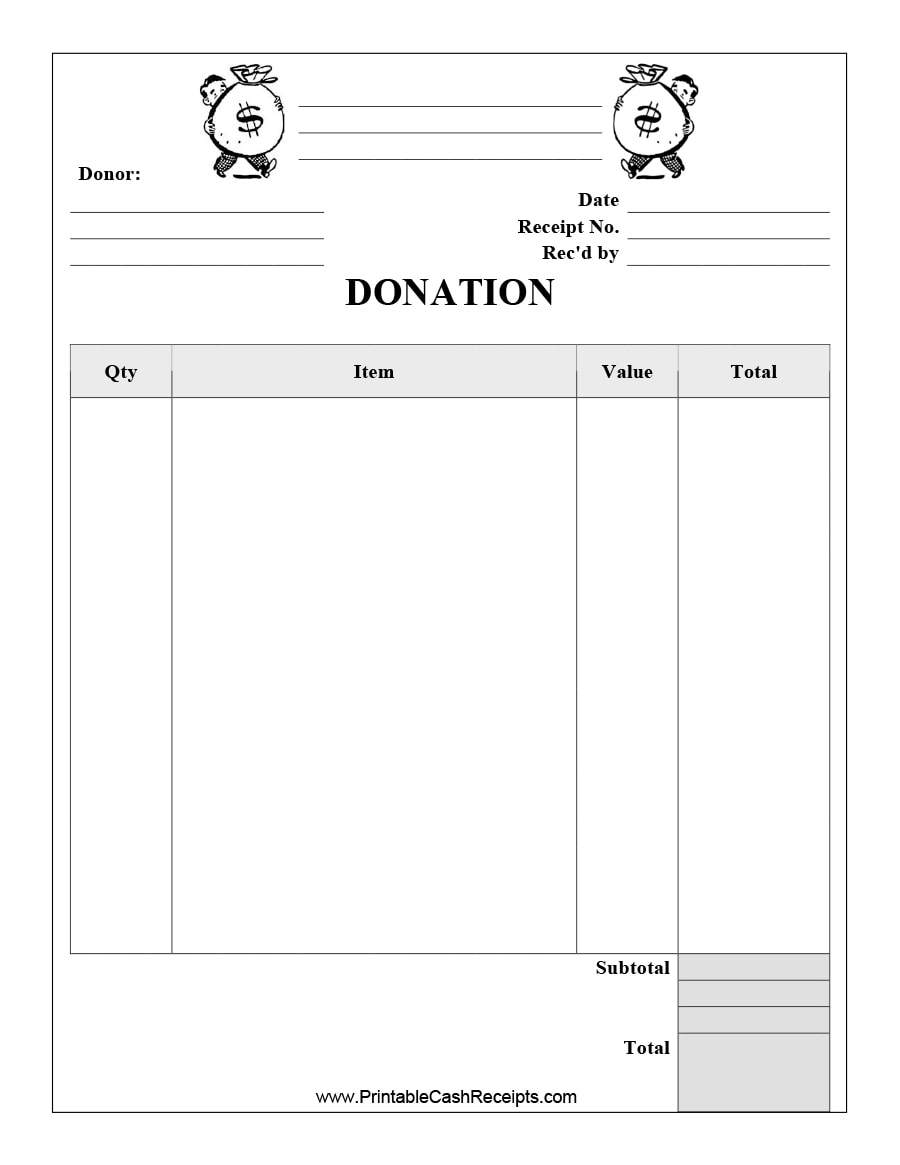

Printable Goodwill Donation Receipt - This form serves as proof of the donation and is essential for donors who wish to. Goodwill donation receipt is a document issued by goodwill industries to individuals who donate items to their organization. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. To claim a deduction on taxes, the. Once you register, and every time you donate your receipts will be filed here electronically. The goodwill donation receipt form is a document that acknowledges the donation of goods to goodwill by an individual or organization. It contains fields to add information about the donor’s date of donation, a description of the donated. Donating and shopping at your local goodwill supports a network of outreach programs that help thousands of people right here in our community. It includes essential instructions for donors on how to fill out the donation receipt for tax purposes. This file provides a detailed donation receipt for contributions to goodwill. This receipt acknowledges the donation of goods such as clothes,. The goodwill donation receipt form is a document that acknowledges the donation of goods to goodwill by an individual or organization. Ideal for tax deductions and supporting your local community. Easily download the goodwill donation receipt form to keep track of your contributions. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. This file provides a detailed donation receipt for contributions to goodwill. This form serves as proof of the donation and is essential for donors who wish to. To claim a deduction on taxes, the. A receipt table at the center of this paperwork shall display the information regarding the goodwill donation in an organized manner once you have supplied the needed information. Then click “donate” to complete the gift. Job training and placement for individuals. As the donor, you are responsible for appraising the. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. The goodwill donation receipt form is a document that acknowledges the donation of goods to goodwill by an individual or organization. A limited number. Once you have entered your donation using the “my donations” tab, you can retrieve your donation receipt via email by clicking the “get receipt” button. The goodwill donation receipt form is a document that acknowledges the donation of goods to goodwill by an individual or organization. If you itemize deductions on your federal tax return, you are entitled to claim. As the donor, you are responsible for appraising the. It contains fields to add information about the donor’s date of donation, a description of the donated. It includes essential instructions for donors on how to fill out the donation receipt for tax purposes. Use this receipt when filing. Thanks for donating to goodwill. Easily download the goodwill donation receipt form to keep track of your contributions. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Once you register, and every time you donate your receipts will be. Ideal for tax deductions and supporting your local community. Then click “donate” to complete the gift. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Use this receipt when filing. This receipt template is fully compliant with donation receipt requirements by the irs. You can either print it or save it. Ideal for tax deductions and supporting your local community. Once you register, and every time you donate your receipts will be filed here electronically. This form serves as proof of the donation and is essential for donors who wish. A goodwill donation receipt is used to claim a tax deduction for any donations made to goodwill, such as clothing or household items. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. You can either print it or save it. Use this receipt when filing. A receipt table. This form serves as proof of the donor's contribution. Job training and placement for individuals. Once you register, and every time you donate your receipts will be filed here electronically. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Once you have entered your donation using the “my. Once you have entered your donation using the “my donations” tab, you can retrieve your donation receipt via email by clicking the “get receipt” button. This receipt acknowledges the donation of goods such as clothes,. Job training and placement for individuals. As the donor, you are responsible for appraising the. Donating and shopping at your local goodwill supports a network. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. But if you’re already thinking of organizing a charitable activity as your own act of “goodwill,” then you can download our free printable receipts to record people’s contributions. This form serves as proof of the donor's contribution. A goodwill. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. This receipt acknowledges the donation of goods such as clothes,. It contains fields to add information about the donor’s date of donation, a description of the donated. If you donated to a goodwill in the following. Then click “donate” to complete the gift. Use this receipt when filing your taxes. This file provides a detailed donation receipt for contributions to goodwill. Goodwill donation receipt is a document issued by goodwill industries to individuals who donate items to their organization. As the donor, you are responsible for appraising the. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. The goodwill donation receipt form is a document that acknowledges the donation of goods to goodwill by an individual or organization. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Ideal for tax deductions and supporting your local community. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Once you register, and every time you donate your receipts will be filed here electronically. This form serves as proof of the donor's contribution.40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Pdf Printable Goodwill Donation Receipt Printable Templates

Goodwill Printable Donation Receipt

Goodwill Donation Receipt Fill Online Printable Fillable —

Pdf Printable Goodwill Donation Receipt Printable Templates

Printable Donation Receipt Template

Free Sample Printable Donation Receipt Template Form

Free Sample Printable Donation Receipt Template Form

Printable Goodwill Donation Receipt

This Receipt Template Is Fully Compliant With Donation Receipt Requirements By The Irs.

Easily Download The Goodwill Donation Receipt Form To Keep Track Of Your Contributions.

Use This Receipt When Filing.

You Can Either Print It Or Save It.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-34.jpg)

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-02.jpg)