Printable 941 Form

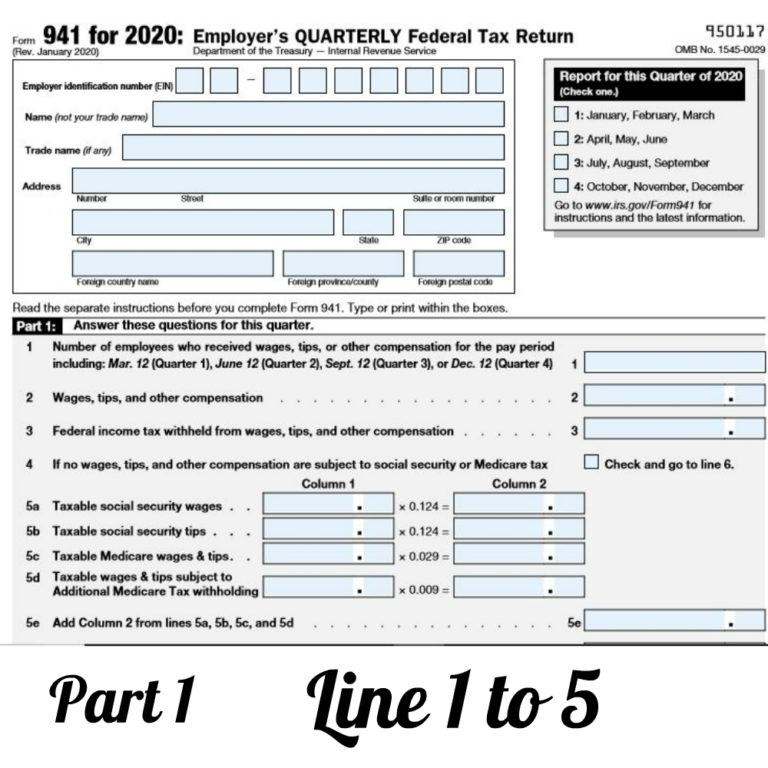

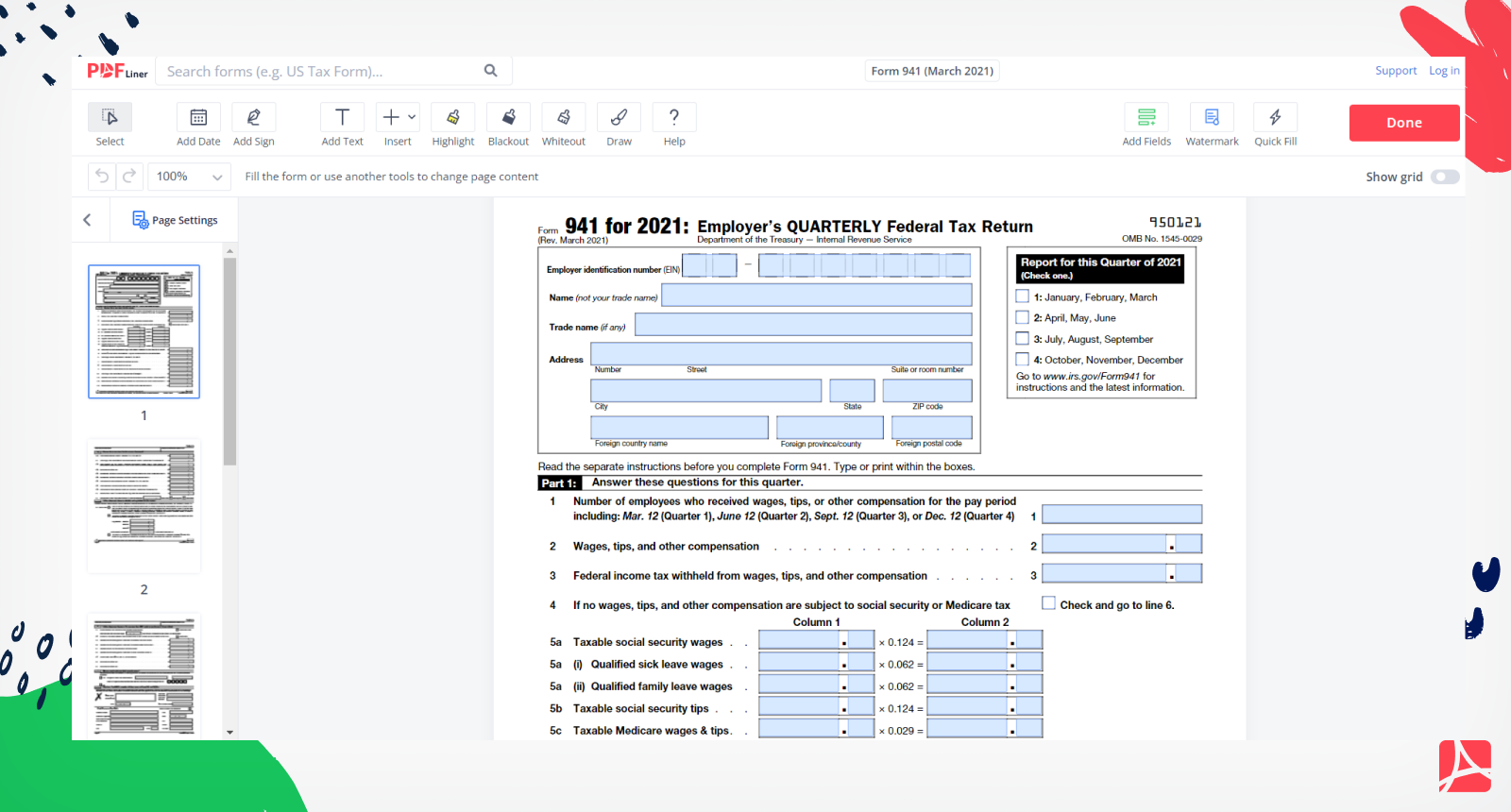

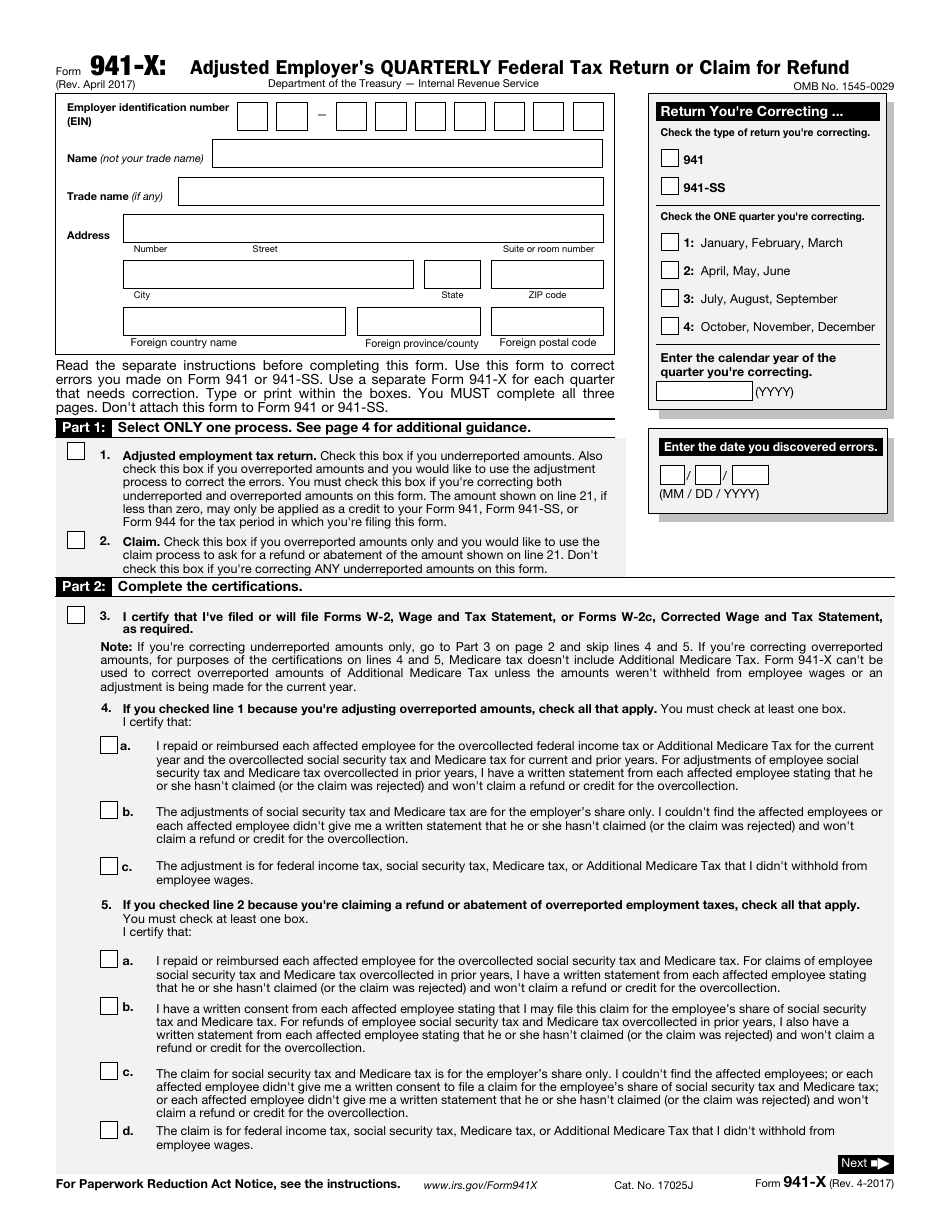

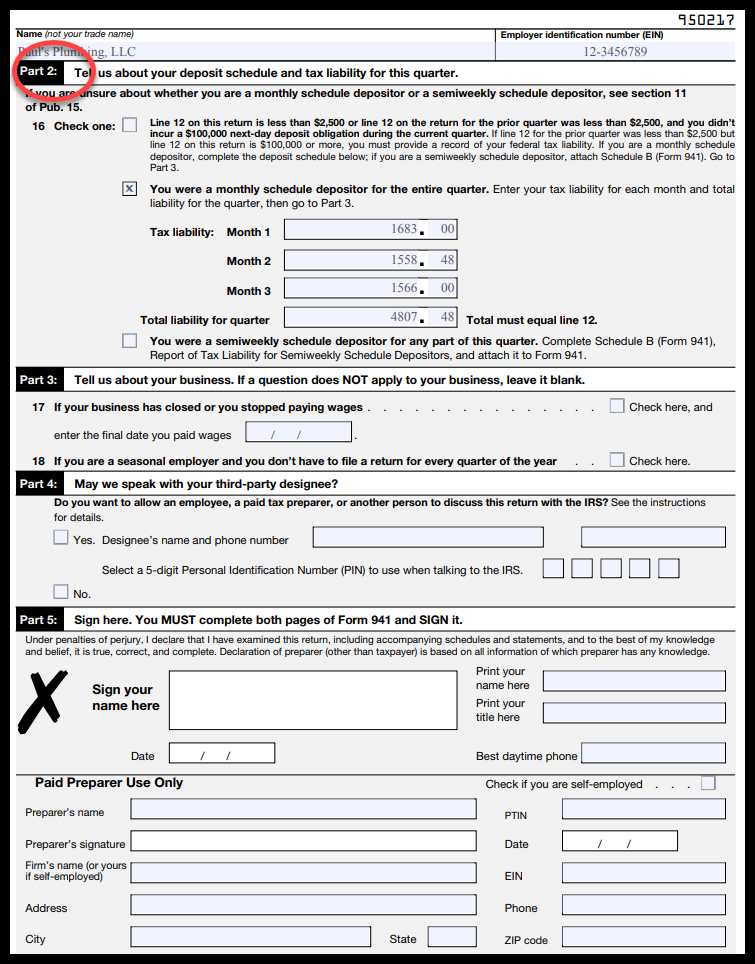

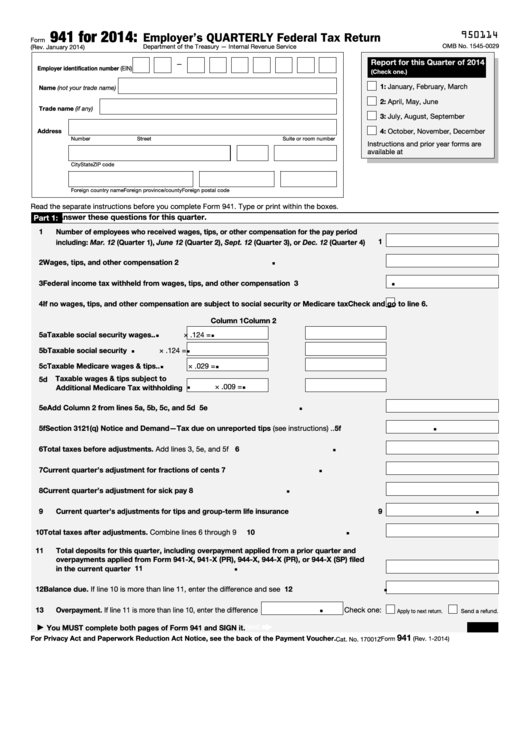

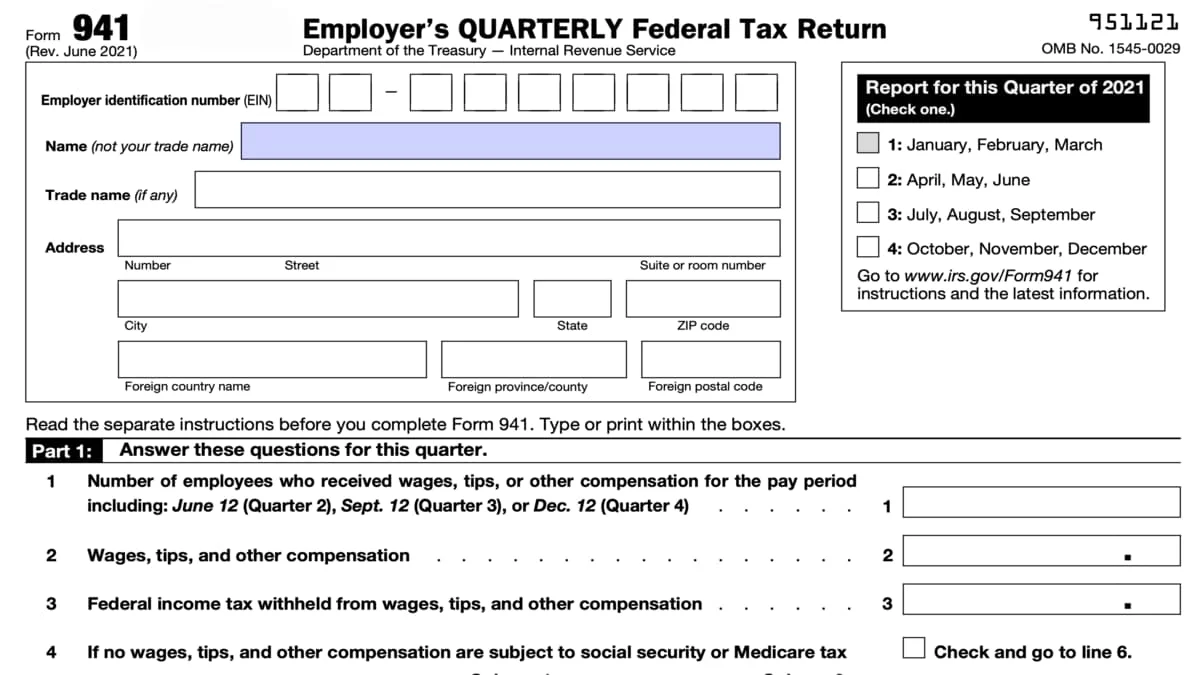

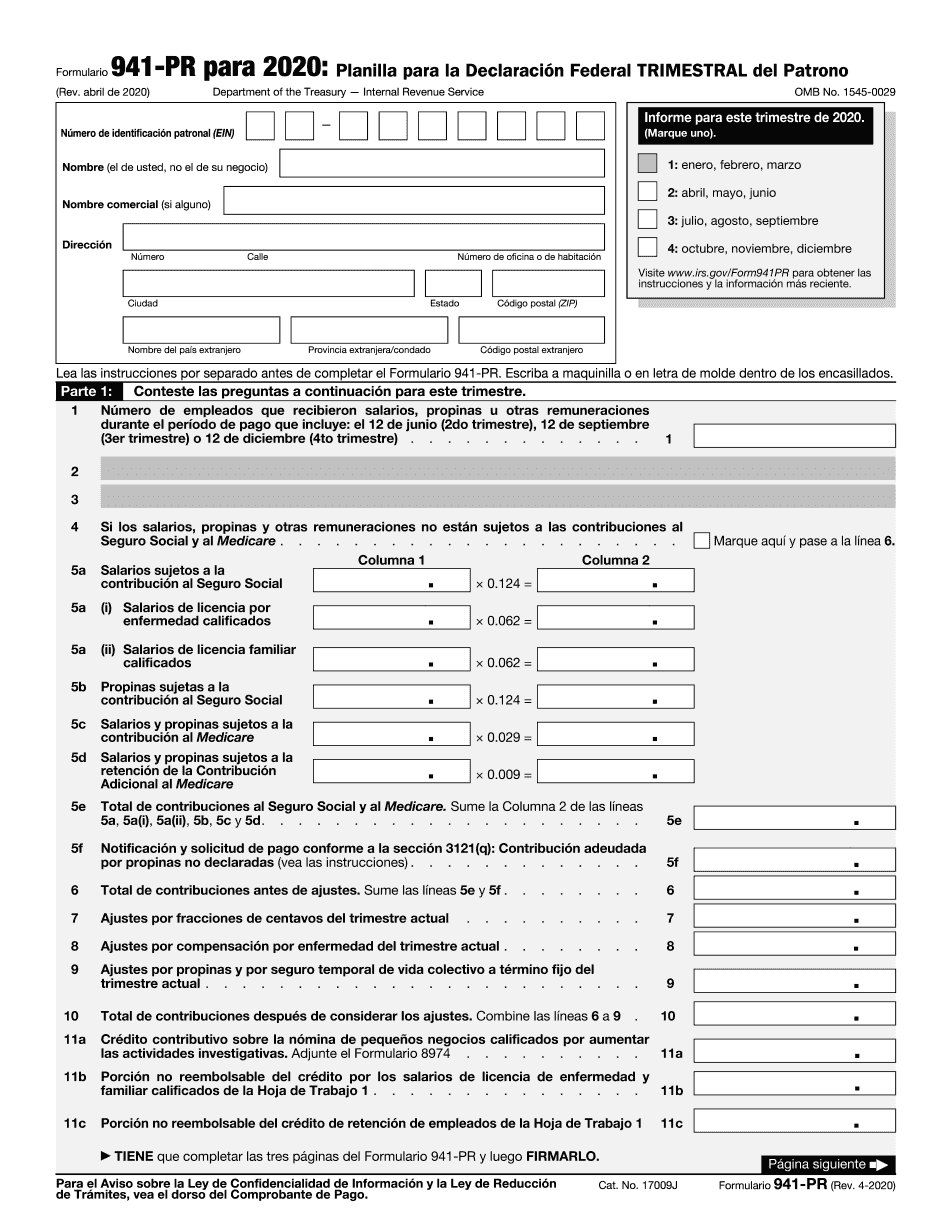

Printable 941 Form - Read the separate instructions before you complete form 941. Follow the instructions and complete the three pages of form 941, including. 1 number of employees who received wages,. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Read the separate instructions before you complete form 941. Answer these questions for this quarter. This form is for income earned in tax year 2024, with tax returns due in april 2025. Answer these questions for this quarter. Type or print within the boxes. The latest versions of irs forms, instructions, and publications. Answer these questions for this quarter. Number of employees who received wages,. For the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. 1 number of employees who received wages,. Read the separate instructions before you complete form 941. Type or print within the boxes. Employers notified by the irs to file form 944, or employer's annual federal tax return, will file annually instead of using the quarterly form 941. Answer these questions for this quarter. 1 number of employees who received wages,. Employers in american samoa, guam, the. Information about form 941, employer's quarterly federal tax. Number of employees who received wages,. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. Read the separate instructions before you complete form 941. Answer these questions for this quarter. 1 number of employees who received wages,. Type or print within the boxes. Follow the instructions and complete the three pages of form 941, including. Answer these questions for this quarter. Information about form 941, employer's quarterly federal tax. Information about form 941, employer's quarterly federal tax. Read the separate instructions before you complete form 941. Type or print within the boxes. 1 number of employees who received wages,. This form is for income earned in tax year 2024, with tax returns due in april 2025. This form is for income earned in tax year 2024, with tax returns due in april 2025. Answer these questions for this quarter. Read the separate instructions before you complete form 941. 1 number of employees who received wages,. Read the separate instructions before you complete form 941. Answer these questions for this quarter. Answer these questions for this quarter. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. Type or print within the boxes. This form is for income earned in tax year 2024, with tax returns due in april 2025. Information about form 941, employer's quarterly federal tax. Type or print within the boxes. Type or print within the boxes. Request for taxpayer identification number (tin) and certification. Employers in american samoa, guam, the. This form must be filed quarterly with the irs to ensure federal payroll tax regulations compliance. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. 1 number of employees who received wages,. Type or print within the boxes. Employers in american samoa, guam, the. Read the separate instructions before you complete form 941. Information about form 941, employer's quarterly federal tax. Number of employees who received wages,. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Number of employees who received wages,. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Answer these questions for this quarter. Employers in american samoa, guam, the. Number of employees who received wages,. Type or print within the boxes. This form is for income earned in tax year 2024, with tax returns due in april 2025. Learn how to accurately fill out irs form 941, the employer's quarterly federal tax return. Answer these questions for this quarter. Answer these questions for this quarter. We will update this page with a new version of the form for 2026 as soon as it is made available by the. Number of employees who received wages,. This form is for income earned in tax year 2024, with tax returns due in april 2025. Answer these questions for this quarter. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. 1 number of employees who received wages,. This form must be filed quarterly with the irs to ensure federal payroll tax regulations compliance. Type or print within the boxes. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Type or print within the boxes. Employers notified by the irs to file form 944, or employer's annual federal tax return, will file annually instead of using the quarterly form 941. Learn how to accurately fill out irs form 941, the employer's quarterly federal tax return. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax.How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

How to Fill out IRS Form 941 Simple StepbyStep Instructions YouTube

Form 941 (March 2021) Printable Blank Form Online — PDFliner

What Employers Need to Know about 941 Quarterly Tax Return?

IRS Form 941X Fill Out, Sign Online and Download Fillable PDF

Form Bavar 2018 941 for 2018 Employer's QUARTERLY

Form 941 for 20 Employer's Quarterly Federal Tax Return

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

941 Form 2022 Printable PDF Template

Printable 941 Form Printable Form 2024

Answer These Questions For This Quarter.

Type Or Print Within The Boxes.

Request For Taxpayer Identification Number (Tin) And Certification.

If A Pdf File Won't Open, Try Downloading The File To Your Device And Opening It Using Adobe Acrobat.

Related Post: