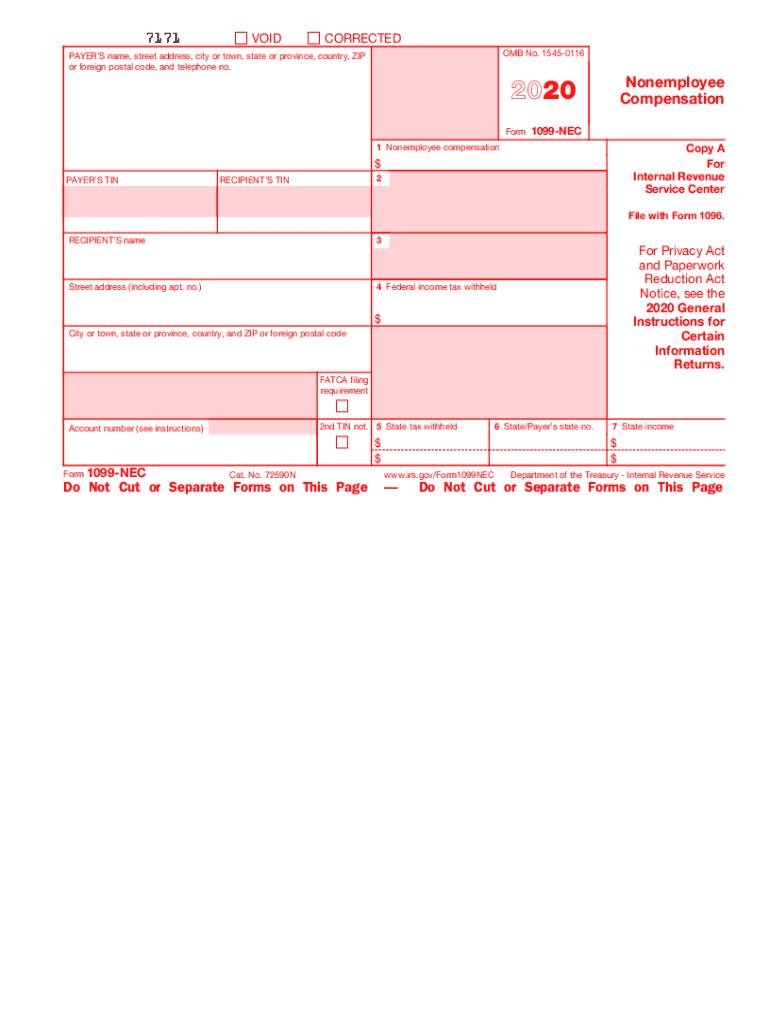

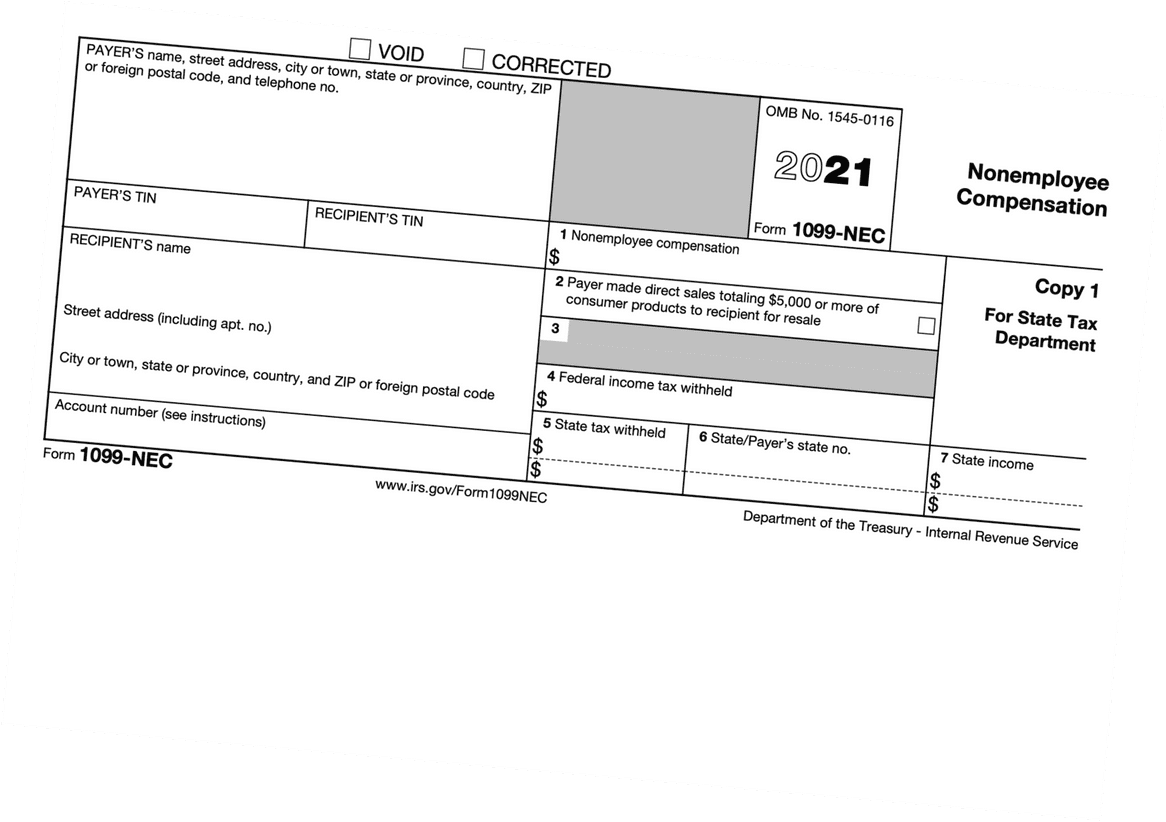

Printable 1099 Nec Form

Printable 1099 Nec Form - There are several ways to obtain the form 1099 nec for your clients: It applies when they receive $600 or more in a. It helps businesses accurately disclose payments made to freelancers or. • the 2021 general instructions for certain information returns, and It is a tax form from the irs. Fill out the nonemployee compensation online and print it out for free. You can order the official copies by mail from the irs. Fill in, efile, print, or. Persons with a hearing or speech disability with access to. What is irs form 1099 nec? Persons with a hearing or speech disability with access to. This form is used to report payments to independent contractors. There are several ways to obtain the form 1099 nec for your clients: It’s also used for reporting payments made for work performed outside of. Fill in, efile, print, or. It helps businesses accurately disclose payments made to freelancers or. Persons with a hearing or speech disability with access to. What is irs form 1099 nec? If your organization paid over $600 for services this year or withheld. It applies when they receive $600 or more in a. • the 2021 general instructions for certain information returns, and This form is used to report payments to independent contractors. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Fill in, efile, print, or. It is a tax form from the irs. You can order the official copies by mail from the irs. Fill in, efile, print, or. • the 2021 general instructions for certain information returns, and It’s also used for reporting payments made for work performed outside of. Persons with a hearing or speech disability with access to. It’s also used for reporting payments made for work performed outside of. Fill out the nonemployee compensation online and print it out for free. • the 2021 general instructions for certain information returns, and It is a tax form from the irs. Persons with a hearing or speech disability with access to. This form is used to report payments to independent contractors. It helps businesses accurately disclose payments made to freelancers or. It is a tax form from the irs. If your organization paid over $600 for services this year or withheld. It applies when they receive $600 or more in a. It applies when they receive $600 or more in a. It helps businesses accurately disclose payments made to freelancers or. If your organization paid over $600 for services this year or withheld. • the 2021 general instructions for certain information returns, and What is irs form 1099 nec? What is irs form 1099 nec? It is a tax form from the irs. If your organization paid over $600 for services this year or withheld. You can order the official copies by mail from the irs. Persons with a hearing or speech disability with access to. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. It helps businesses accurately disclose payments made to freelancers or. Persons with a hearing or speech disability with access to. Fill in, efile, print, or. It is a tax form from the irs. You can order the official copies by mail from the irs. This form is used to report payments to independent contractors. It is a tax form from the irs. What is irs form 1099 nec? Persons with a hearing or speech disability with access to. • the 2021 general instructions for certain information returns, and It is a tax form from the irs. Persons with a hearing or speech disability with access to. Persons with a hearing or speech disability with access to. It helps businesses accurately disclose payments made to freelancers or. If your organization paid over $600 for services this year or withheld. It helps businesses accurately disclose payments made to freelancers or. Persons with a hearing or speech disability with access to. It applies when they receive $600 or more in a. You can order the official copies by mail from the irs. Persons with a hearing or speech disability with access to. It helps businesses accurately disclose payments made to freelancers or. It applies when they receive $600 or more in a. You can order the official copies by mail from the irs. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. What is irs form 1099 nec? Persons with a hearing or speech disability with access to. There are several ways to obtain the form 1099 nec for your clients: Fill out the nonemployee compensation online and print it out for free. • the 2021 general instructions for certain information returns, and This form is used to report payments to independent contractors. Fill in, efile, print, or.Tax Form 1099NEC > Printable IRS 1099NEC Form for 2023 & Free

Printable 1099 Nec 2024

Printable Irs Form 1099 Nec

How to File Your Taxes if You Received a Form 1099NEC

Printable Irs 1099 Nec Form

Free Printable 1099NEC File Online 1099FormTemplate

Printable Fillable 1099 Nec

Printable Form 1099 Nec

Printable Form 1099nec 2022

Printable Irs Form 1099 Nec

If Your Organization Paid Over $600 For Services This Year Or Withheld.

It’s Also Used For Reporting Payments Made For Work Performed Outside Of.

It Is A Tax Form From The Irs.

Related Post:

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)