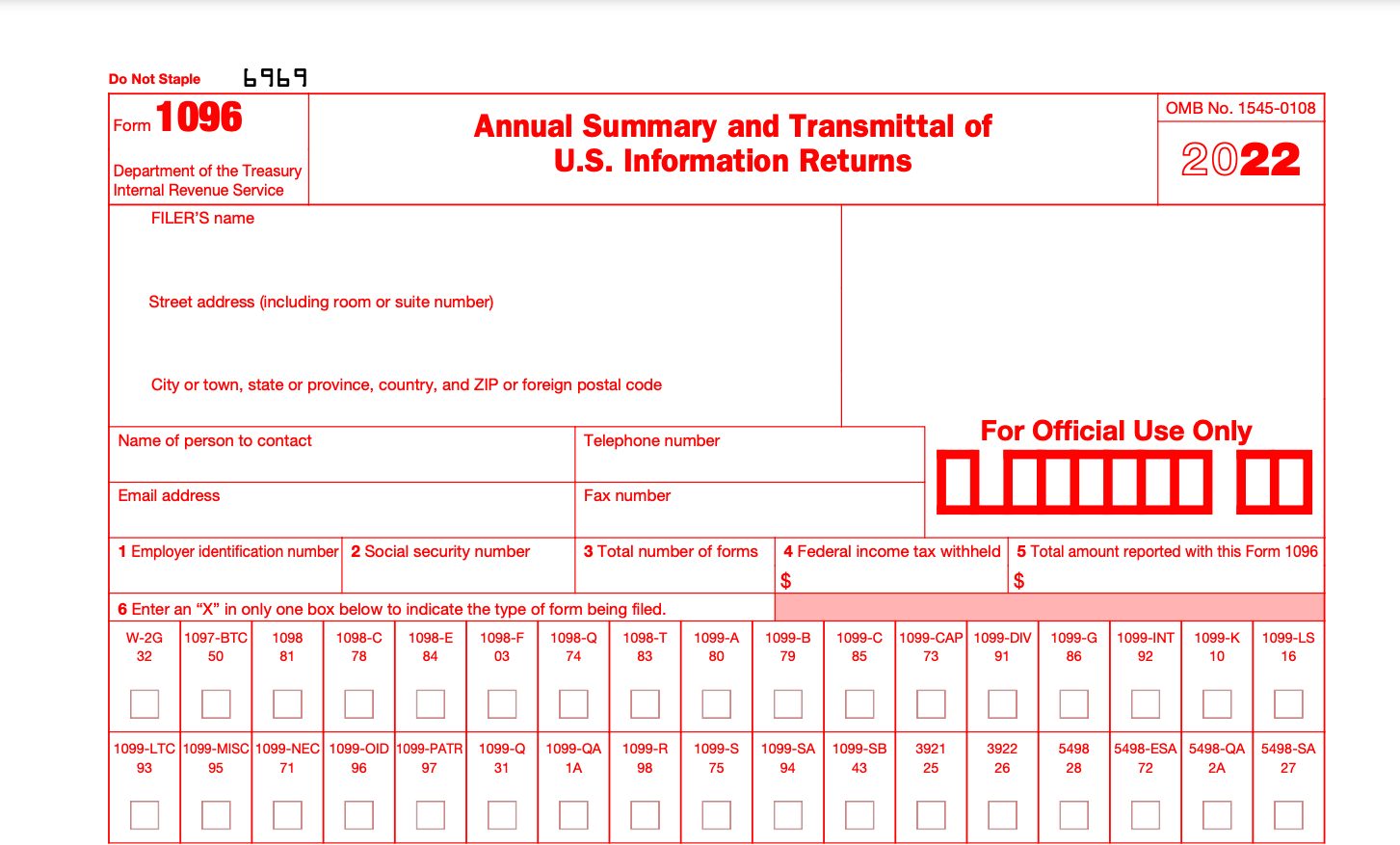

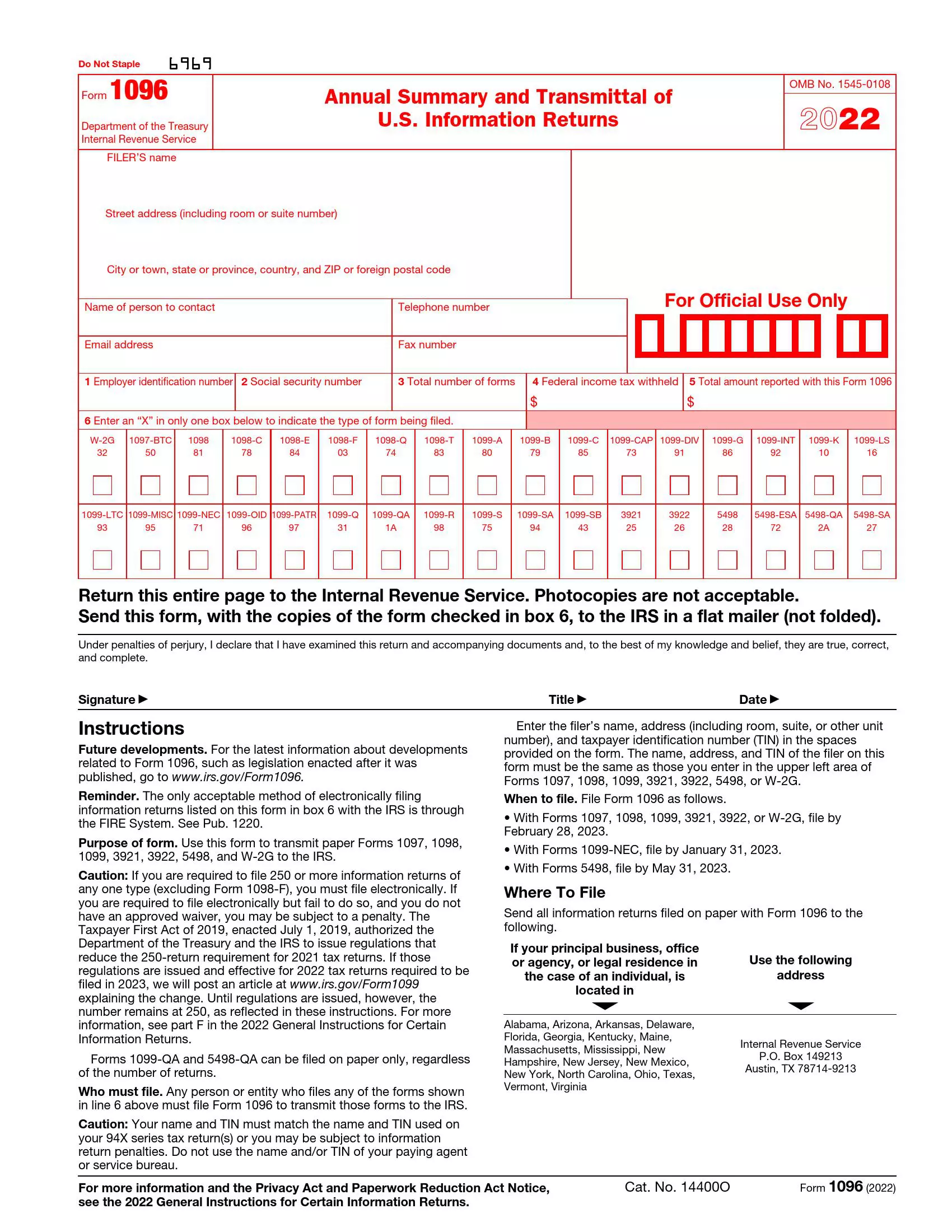

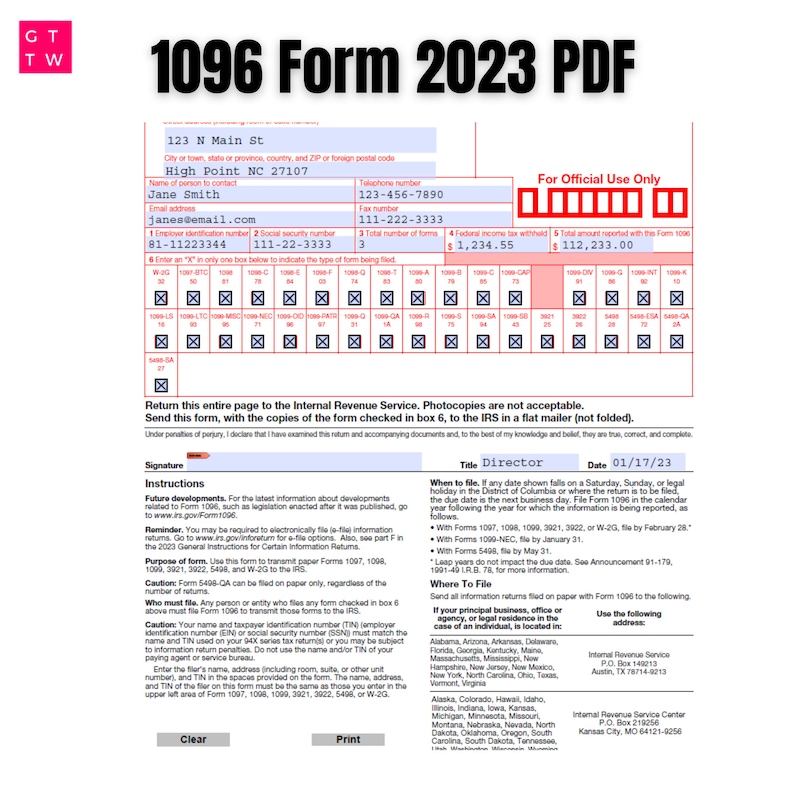

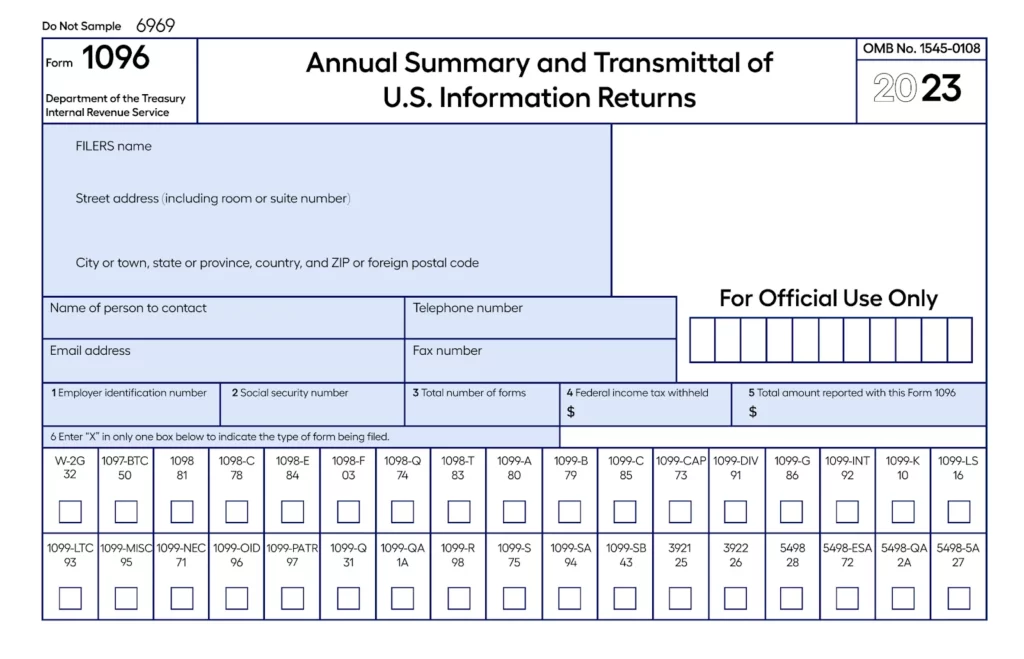

Form 1096 Printable

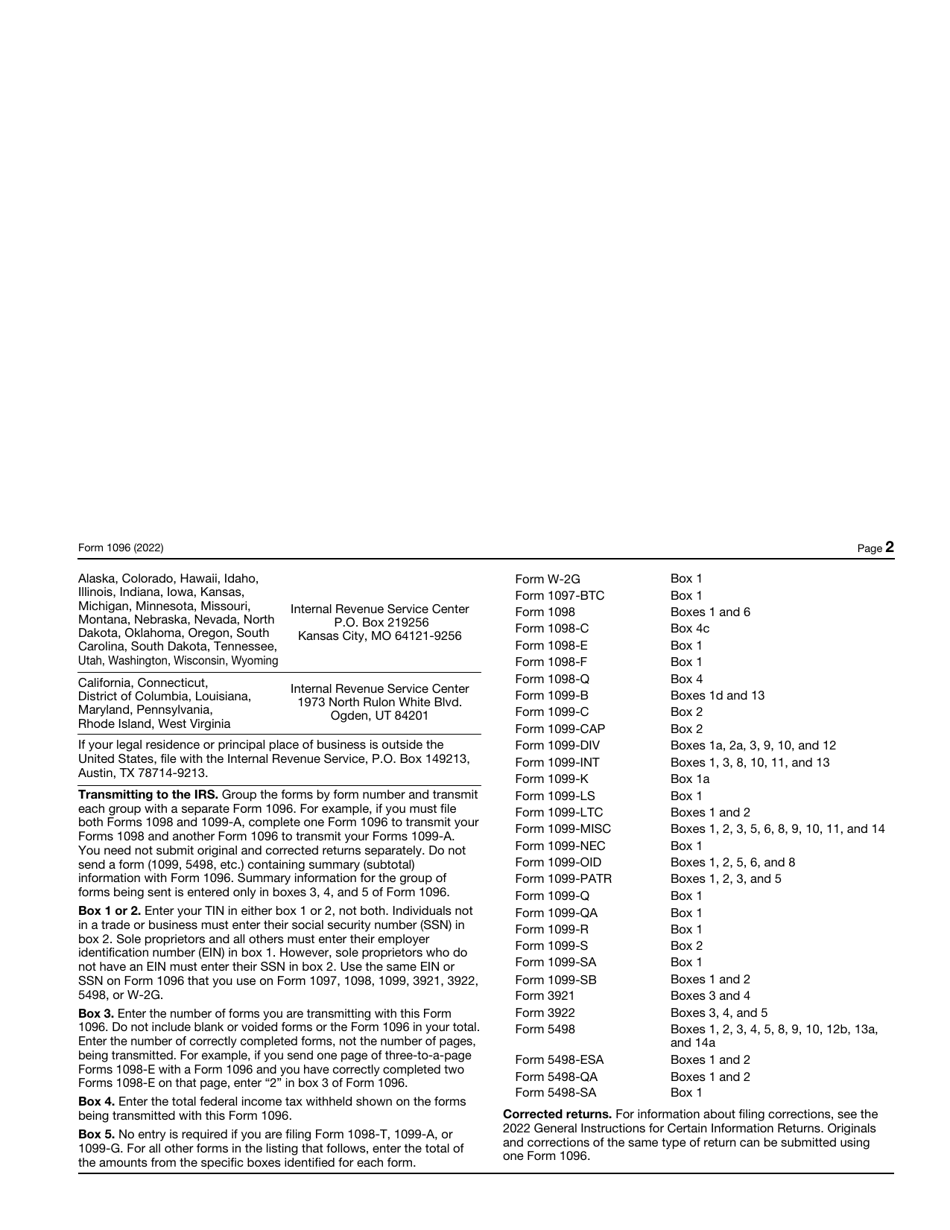

Form 1096 Printable - This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including forms 1099, 1098, 5498, 3921,. This form is for income earned in tax year 2024, with tax returns due in april 2025. Unlike most tax forms, form 1096 serves as a summary rather than a source of. A new 1096 form is required when errors are found in the original submission. To order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. These errors might include incorrect totals or mismatched information between the 1096 and the. Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. Form 1096, the annual summary and. Irs form 1096 is the annual summary and transmittal of u.s. Form 1096 is used when you're submitting paper 1099 forms to the irs. These errors might include incorrect totals or mismatched information between the 1096 and the. Form 1096, the annual summary and. If you are filing electronically, form. A new 1096 form is required when errors are found in the original submission. Information about form 1096, annual summary and transmittal of u.s. Form 1096 is also titled annual summary and. In this guide, we’ll simplify form 1096 for you. To order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including forms 1099, 1098, 5498, 3921,. Do not print and file a form 1096 downloaded from this website; The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. Irs form 1096 is the annual summary and transmittal of u.s. File form 1096 in the calendar year following the year for which the information is being reported, as follows.. File form 1096 in the calendar year following the year for which the information is being reported, as follows. File form 1096 in the calendar year following the year for which the information is being reported, as follows. File form 1096 as follows. Form 1096 is used by. Form 1096 is also titled annual summary and. Form 1096, the annual summary and. File form 1096 in the calendar year following the year for which the information is being reported, as follows. If you are filing electronically, form. Unlike most tax forms, form 1096 serves as a summary rather than a source of. Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks. Form 1096, the annual summary and. See part o in the current. Form 1096 is also titled annual summary and. File form 1096 in the calendar year following the year for which the information is being reported, as follows. This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including. Form 1096 is used when you're submitting paper 1099 forms to the irs. However, while you can download and print form 1096 for informational or preparation purposes, the irs requires the. A new 1096 form is required when errors are found in the original submission. Irs form 1096 is the annual summary and transmittal of u.s. File form 1096 in. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Form 1096 is used when you're submitting paper 1099 forms to the irs. However, while you can download and print form 1096 for informational or preparation purposes, the irs requires the. Form 1096 is also titled annual summary and. This guide provides detailed. Form 1096, the annual summary and. If you are filing electronically, form. These errors might include incorrect totals or mismatched information between the 1096 and the. Form 1096 is used when you're submitting paper 1099 forms to the irs. Information about form 1096, annual summary and transmittal of u.s. Form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. File form 1096 in the calendar year following the year for which the information is being reported, as follows. These errors might include incorrect totals or mismatched information between the 1096 and the. File form 1096 as. To order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Form 1096 is also titled annual summary and. Unlike most tax forms, form 1096 serves as a summary rather than a source of. Yes, form 1096 is available as a free download on the irs website. Form 1096, the annual summary. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including forms 1099, 1098, 5498, 3921,. However, while you can download and print form 1096 for informational or preparation purposes, the irs requires. If you are filing electronically, form. This form is for income earned in tax year 2024, with tax returns due in april 2025. Information returns, including recent updates, related forms and instructions on how to file. Information about form 1096, annual summary and transmittal of u.s. Irs form 1096 is the annual summary and transmittal of u.s. Do not print and file a form 1096 downloaded from this website; See part o in the current. A new 1096 form is required when errors are found in the original submission. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. We will update this page with a new version of the form for 2026 as soon as it is made available by the. This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including forms 1099, 1098, 5498, 3921,. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. File form 1096 as follows. Click on employer and information returns, and we’ll mail.Form 1096

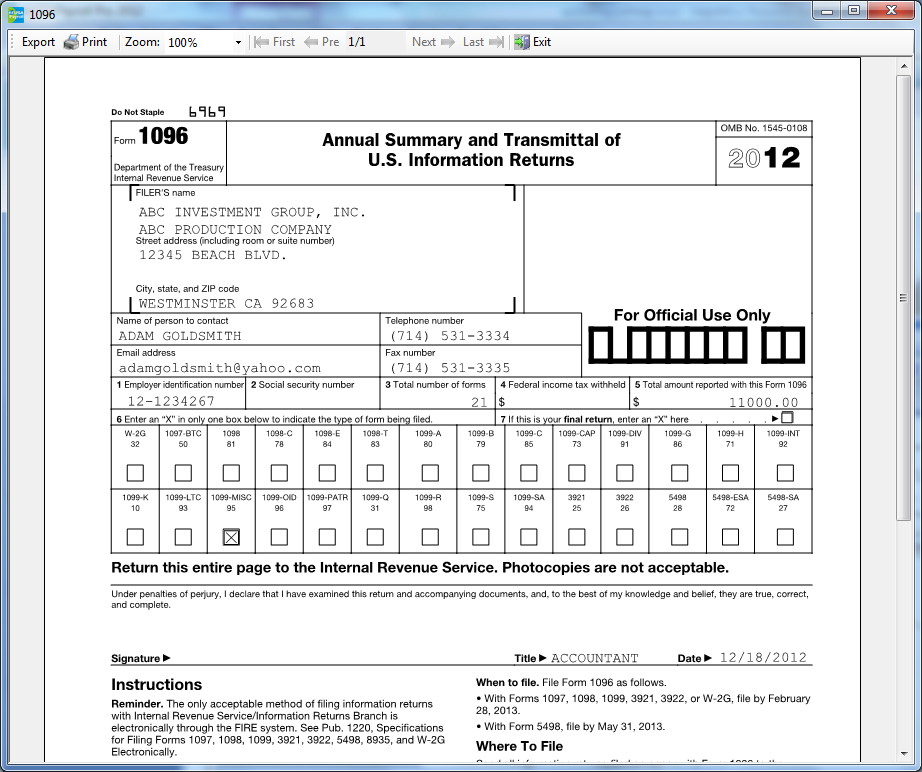

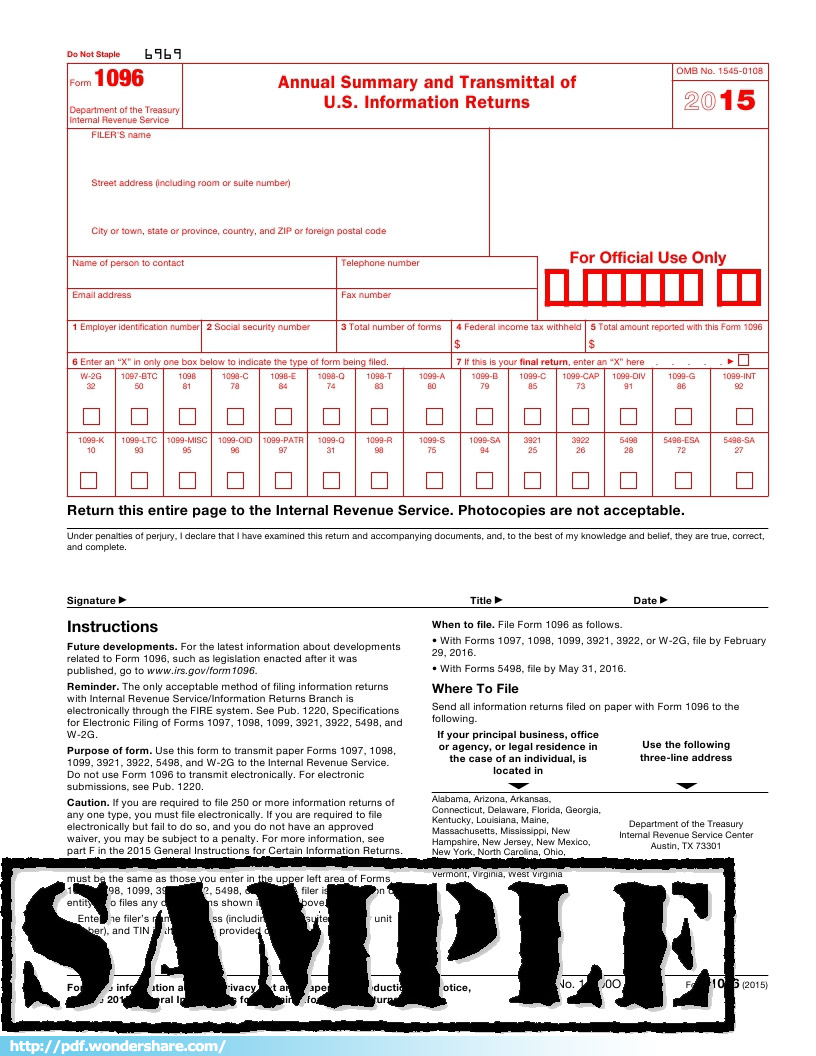

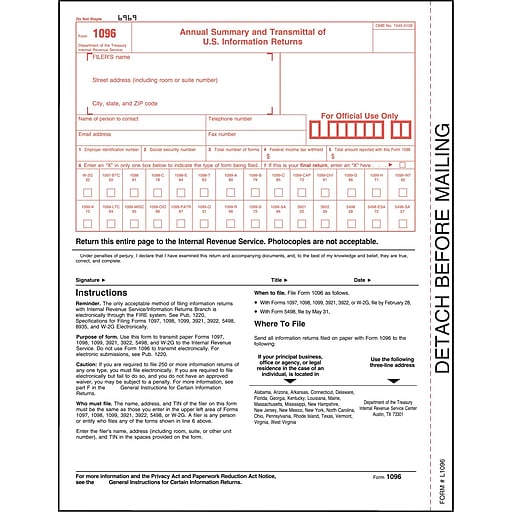

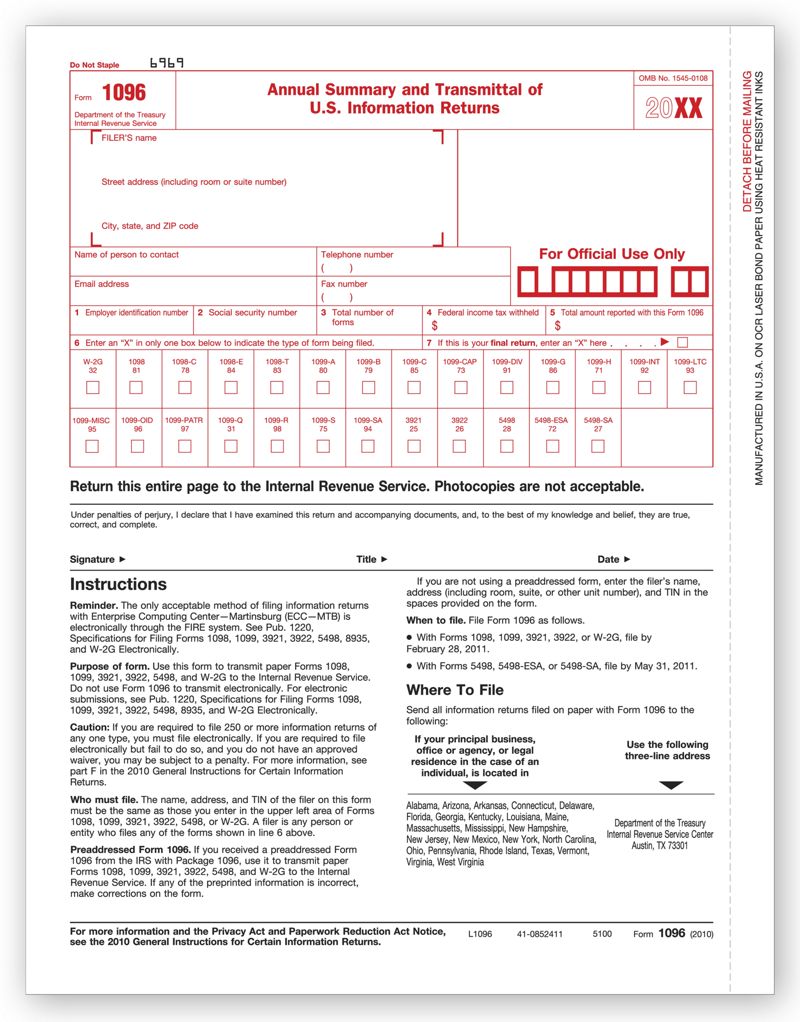

IRS 1096 Form Download, Create, Edit, Fill and Print

Irs Form 1096 Fillable Universal Network

Fillable 1096 Form Printable Forms Free Online

Printable Form 1096 Form 1096 (officially the annual summary and

Form 1096 A Simple Guide Bench Accounting

IRS Form 1096 ≡ Fill Out Printable PDF Forms Online

1096 IRS PDF Fillable Template 2023/2024 With Print and Clear Buttons

Understanding and Filing Form 1096 Multiplier

IRS Form 1096 Download Printable PDF or Fill Online Annual Summary and

However, While You Can Download And Print Form 1096 For Informational Or Preparation Purposes, The Irs Requires The.

These Errors Might Include Incorrect Totals Or Mismatched Information Between The 1096 And The.

Form 1096 Is Used When You're Submitting Paper 1099 Forms To The Irs.

File Form 1096 In The Calendar Year Following The Year For Which The Information Is Being Reported, As Follows.

Related Post: